A self-made chip puts Huawei back in the smartphone game, but US sanctions are still hurting the company.

This is going to be a BIG week for US-China relations: On Wednesday, Xi Jinping will sit down with Joe Biden in San Francisco and talk about military issues, trade, and more. It will be his first visit to the US in six years.

Well, so much has happened since 2017. A harmonious era in US-China relations ended; we’ve seen a trade war, a pandemic, an ongoing technology rivalry, an off-course spy balloon, and too many other tumultuous developments to list here.

It’s in this context that Huawei, the Chinese telecom and technology company, became something of a poster child for souring relations. It was one of the first Chinese tech companies to receive intense scrutiny and become a target for sanctions driven by national security concerns. In fact, many of the ways the US currently deploys sanctions in the US-China tech war are inspired by its success in curbing Huawei. (If you want to know more about the fight over semiconductors, read more from me here and here.)

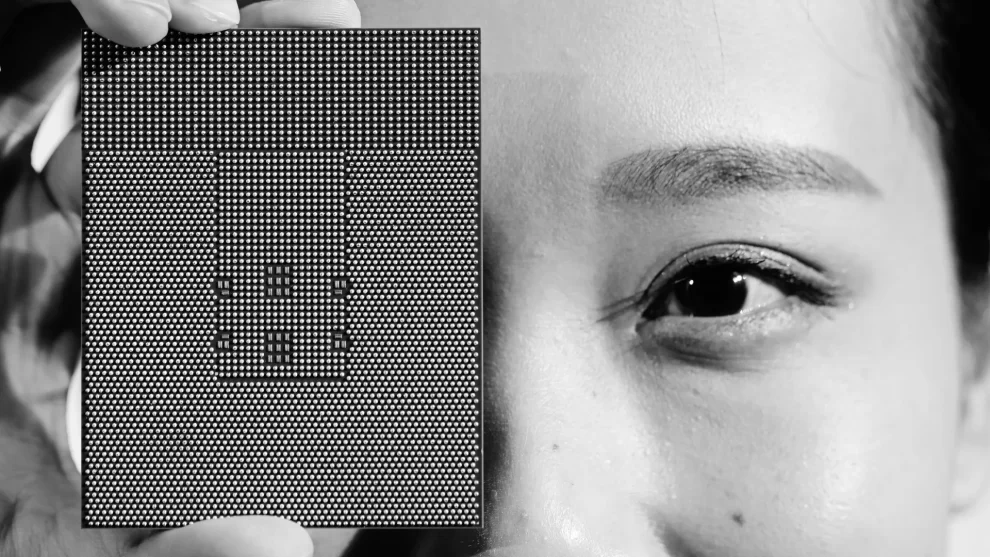

But it’d be a mistake to think Huawei has collapsed. Far from it, in fact. In August—at the same time US Commerce Secretary Gina Raimondo was visiting China—Huawei suddenly, without any public announcement, shocked the world when it started selling a new flagship phone, the Mate 60 Pro.

The big surprise here was that this phone uses a new 5G chip, even though the company has been blocked from sourcing 5G chips or working with chip factories outside of China since 2020. So regulators in DC and other China hawks panicked that the relatively advanced seven-nanometer chip proved the company had somehow circumvented sanctions.

But had it really? Researchers who broke down the chip believe that it seems to be entirely designed by Huawei and made in China.

I’ve been wanting to understand what really happened here—and what it means more broadly for the ongoing competition over chips and other tech. So I recently spoke with Harish Krishnaswamy, a professor at Columbia University who studies telecommunications and chip designs.

The bottom line is that the Mate 60 Pro shows a manufacturing breakthrough on Huawei’s side that puts it back into the smartphone game. “It’s clearly wrong to assume that they’re not a player because of the sanctions,” Krishnaswamy told me.

He explained that the designing of 5G chips is not necessarily difficult for Chinese researchers and companies, so it wouldn’t have been that hard for Huawei to create a 5G chip in the lab. What is much harder is mass-producing a 5G chip at great quality and reasonable costs so it can be used in a consumer product.

Producing advanced 5G chips “is just a very large engineering endeavor that very few companies can pull off,” he says. Only a handful of companies—like Qualcomm (American), MediaTek (Taiwanese), Samsung (South Korean), and HiSilicon (a chip company that is a Huawei subsidiary)—have successfully made 5G modem chips. Even tech giants like Intel and Apple have failed so far to develop in-house 5G chips.

So when the US sanctions blocked companies from supplying chips to Huawei for its phones, the Chinese manufacturer had no choice but to rely on HiSilicon alone.

But the sanctions also cut HiSilicon off from the global network of factories (called “foundries” or “fabs” in the semiconductor industry) that are vital in manufacturing and testing the products. TSMC, the Taiwanese chip fab that was making chips for HiSilicon at the time, stopped supplying it in 2020.

This further narrowed the options for Huawei. It could only turn to Chinese fabs, and that was a costly and time-consuming process. “Anytime you’ve designed a chip in a fab and then, for some reason, you cannot source that anymore and move to another company, just that process of redesigning, qualification, and ramping production takes at least three years,” says Krishnaswamy, who also owns a chip company that works closely with fabs.

Then, making things even more challenging for Huawei, Chinese chip fabs were later put under sanctions and now can’t access any cutting-edge chip-making technologies.

So when Huawei made the smartphone with a new 5G chip earlier this year, Krishnaswamy says, the industry was surprised by how quickly it had been able to turn around a design, shift to a Chinese fab, manufacture the new chip, and get it to production rate, all while having to deal with significant revenue losses caused by sanctions. “For Huawei to show [that it is] able to do that is definitely impressive,” he says.

Indeed, since news came out that it was making its own 5G chips in Chinese fabs with minimum overseas input, the company has become a source of national pride for many in China. For them, it’s an example of how US sanctions don’t always work as intended. They may force Chinese companies to adapt, move production back to China, and catch up in areas of tech where they had lagged—and that can ultimately work out in China’s favor.

Still, it may be too early for them to cheer, as there are other obstacles to clear before Huawei can become competitive in the high-end phone market again.

“After any company shows proof of life—basically, that they have a chip—the long-term success is really governed by the ability to source [it] in large volumes and get the costs down over time,” Krishnaswamy says.

Huawei is experiencing a reality check right now. A few months after the release of the new model, domestic enthusiasm has been hurt by the fact that it’s still very difficult for consumers to get a phone. They are back-ordered for months because of a supply shortage. In fact, just this past weekend, which was China’s equivalent of Black Friday, the top-selling phones were still from Apple and Xiaomi (another Chinese brand).

At the end of the day, for any chance of regaining its dominant position in the smartphone market, Huawei needs to compete with Qualcomm and Samsung to reliably make better and cheaper chips, and that’s very difficult to pull off. The US chip blockade, which is consistently being expanded and strengthened, will only make it harder in the future—even if it hasn’t made it impossible thus far.

Unless the Biden-Xi meeting produces some truly surprising results this week, the bitter winter of US-China relations may continue for years. In which case there are a lot more battles ahead for Chinese companies like Huawei, and one breakthrough in chip manufacturing won’t be enough.

Source : MIT Technology Review