Asia and the Pacific remains a dynamic region despite the somber backdrop of what looks to be shaping up as a challenging year for the world economy.

Global growth is poised to decelerate as rising interest rates and Russia’s war in Ukraine weigh on activity. Inflation remains stubbornly high, and banking strains in the United States and Europe have injected greater uncertainty into an already complex economic landscape.

Asia’s domestic demand has so far remained strong despite monetary tightening, while external appetite for technology products and other exports is weakening. We project the region will contribute more than 70 percent of global growth this year as its expansion accelerates to 4.6 percent from 3.8 percent last year.

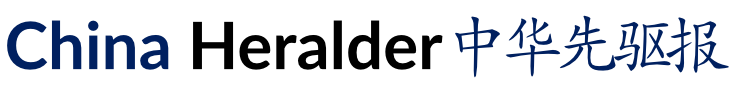

China’s reopening will provide fresh momentum. Normally the strongest effect would be from demand for investment goods in China, but this time the biggest effect is from demand for consumption. Other emerging economies in the region are on track to enjoy solid growth, though in some cases at slightly lower rates than seen last year.

Even so, the dynamic growth outlook doesn’t mean policymakers can be complacent. Some risks—such as public debt—we have recently discussed (including in our January blog) remain. Intensification of the recent global financial tremors could spark others.

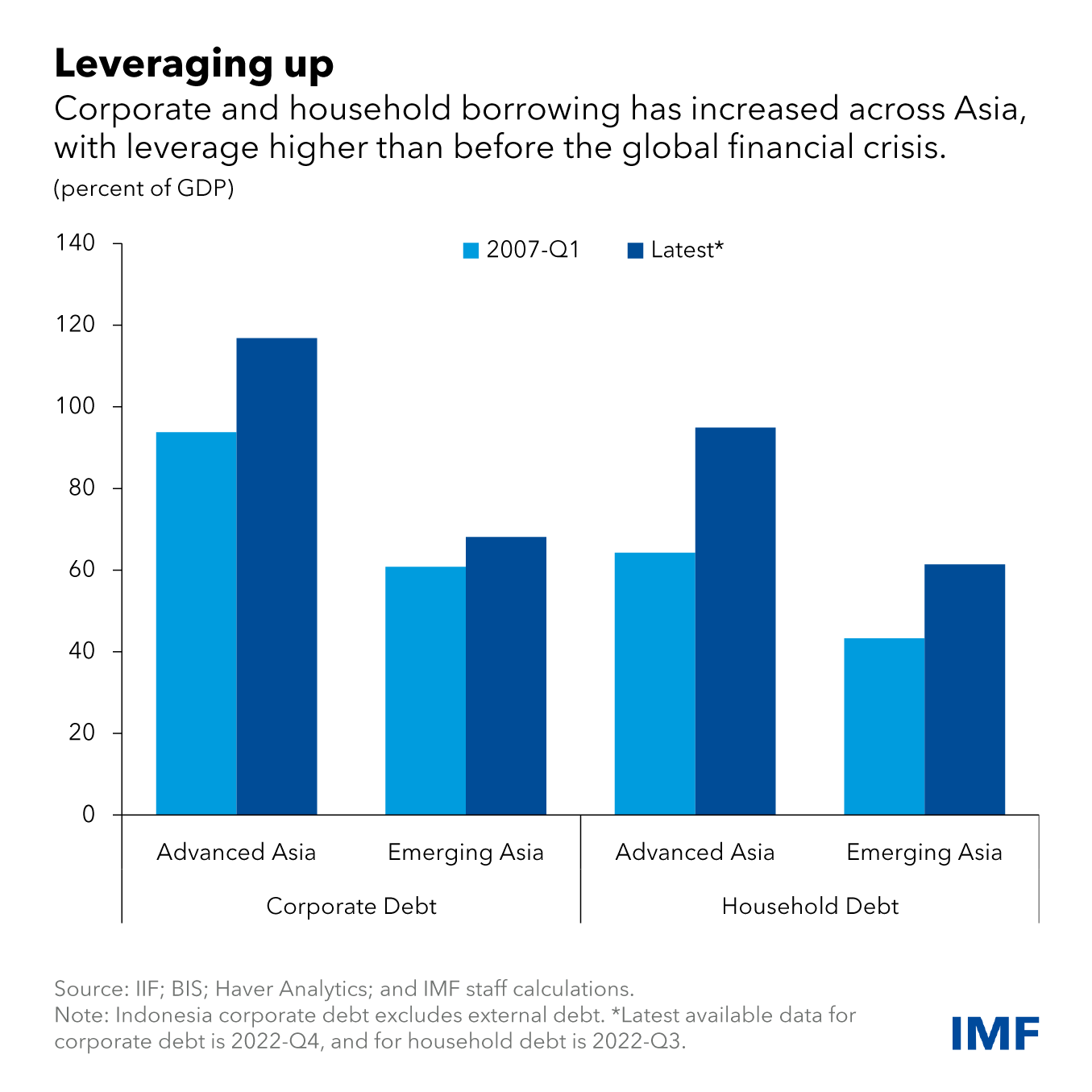

Beyond these risks, persistent inflation remains a challenge. Global commodity prices have moderated after surging last year and supply chain pressures have eased, but inflation remains above central banks’ targets. Core inflation, which excludes food and energy, has also proven sticky.

Output gaps—measures of how closely demand is running to the capacity to meet demand, and hence the pressure on prices—for Asian economies are either narrowing or have already closed, while levels of economic capacity themselves might have fallen as a result of so-called economic scarring from the pandemic.

The effect of currency depreciation against the US dollar last year is still passing through to prices. The impact could be greater than usual, because of the already-high inflation, especially for emerging economies. These factors suggest that the battle to contain inflation isn’t over. With real interest rates still low—and negative in some countries—central banks may need to keep interest rates higher for longer.

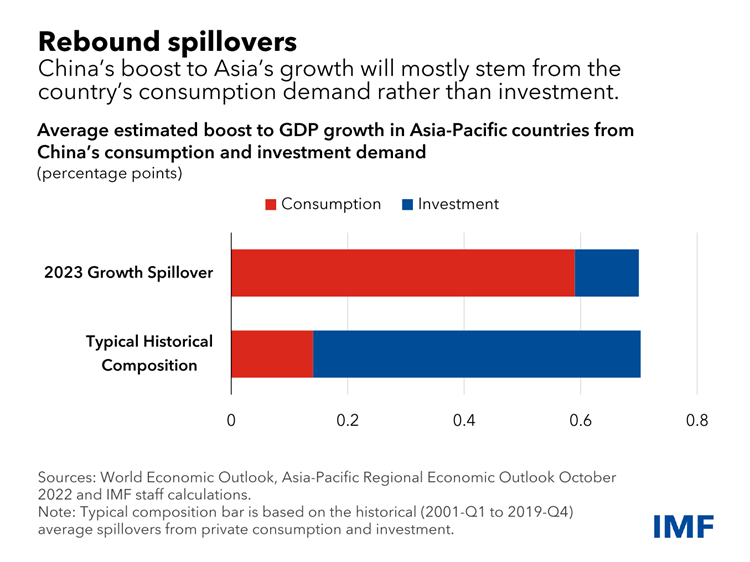

The significant uncertainty about the path of global and regional financial conditions presents another challenge. The recent turbulence in some US and European banks serves as a cautionary tale about contagion risks. We have seen how some banks in Europe and the United States have struggled with rising interest rates.

Similarly, banks in Asia—particularly in advanced economies—could suffer losses from increases in wholesale funding costs and sudden declines in the market values of assets. Lenders in some emerging economies could face liquidity stresses following sudden deposit withdrawals or retrenchment in external funding lines. Some countries and sectors are significantly exposed to a sharp increase in external borrowing costs, though these risks have recently diminished somewhat.

Even aside from the potential spillovers from these kinds of external stresses, domestic vulnerabilities are evident. Leverage had increased even before the pandemic. Corporate debt is concentrated in firms at risk of insolvency and in a few sectors, such as property. Real estate prices in Asia are still historically high even after recent cooling; further declines could pressure banks’ balance sheets, especially those exposed to mortgage lending and real estate developers. Asian financial systems should be able to withstand these stresses as they are well capitalized and have strong liquidity buffers, but financial supervisors must be alert.

Fiscal consolidation amid high debt and rising interest rates is another challenge. Public debt levels in the region have increased significantly compared to before the pandemic. Most governments are expected to tighten budgets this year and next. However, the projected consolidation may not be enough to stabilize debt, and rising interest rates would make the burden even heavier.

Finally, there are heightened risks to economic growth in coming years. Although China is expected to rebound this year, it is likely to slow over the medium term, implying the lowest such growth rates for Asia in decades. In addition, China’s growth is likely to shift from investment to consumption. This could have significant implications for the region, especially for economies with sizable exports to China. Greater geoeconomic fragmentation would also add to pressures on growth potential.

What do these challenges mean for policymakers?

The best remedy for financial stress is prevention—policymakers should keep a close eye for stresses and develop contingency plans. Unless strains in financial markets increase and raise broad-based stability concerns, central banks should separate monetary policy objectives from financial stability goals. To do so, they should use available tools—such as lending and discount facilities—to ease any liquidity constraints in the banking sector, allowing them to continue to tighten policy to address inflationary pressures.

Fiscal consolidation may need to be more aggressive to ensure sustainability over the medium term—but policymakers must strike a balance between supporting growth, protecting the vulnerable, and addressing debt concerns.

The region must prioritize policy initiatives that foster innovation-driven economic development. The green transition presents a wide range of innovation opportunities that can become the region’s new growth drivers if leveraged effectively. By investing in research and development, promoting entrepreneurship, strengthening education and digitalization, Asian countries can foster sustainable, long-term growth.

Source: IMF